The uncertainty around any positive development on a potential Coronavirus slowdown or vaccine persists, and the equity markets have more than discounted the likelihood of major consequences on the real economy.

在由冠状病毒带来的经济放缓是否能被逆转,以及疫苗是否能尽快被研发的问题上,不确定性一直存在。但这次疫情对实体经济产生重大影响的可能性并没有成为股票市场的担忧。

The S&P 500 has touched its historical highest level and closed at 3345 with it being 4 percent up on the year-to-date. Pharmaceuticals, for obvious reasons, and defensive sectors in general have been the ones that showed more resilience during the nCov outbreak crisis and have been seen to outperform.

标普500指数已触及历史最高水平,收于3345点,年初至今上涨了4%。显然,在新型冠状病毒肺炎爆发的同时,制药业和防御性行业表现出了更大弹性,表现优于市场。

Industries that have been highly exposed to China, such as semi-conductors and automotive, have continued to struggle. That said, Tesla suddenly gained more than 60% over the past 6 trading days as optimism about the electric automaker spiked.

与中国存在高度相关性的行业,例如半导体和汽车行业,仍受到影响。与此同时,由于对电动汽车制造商的乐观情绪飙升,特斯拉在过去6个交易日中猛涨60%以上。

However, Tesla announced the virus issue will largely impact their delivery projections in China (stock edged down 7 percent). Consider Tesla currently has a market capitalization of a fraction of Ford/General Motors, whilst it is 43% higher than the gigantic VW (10million deliveries in 2019 vs 500K projected by TSLA).

然而,特斯拉也表示,疫情将在很大程度上影响中国区的交付时间(股价微跌7%)。特斯拉目前的市值仅为福特/通用汽车的一小部分,但比庞大的大众汽车集团高出了43%(大众汽车在2019年交付了1000万辆汽车,而特斯拉预计为50万辆)。

In the meantime, US Government securities have lowered in yield as sentiment around a potential global health emergency escalated. The Treasuries are still highly bid, although the stock market has more than recovered the slight price correction, meaning that active investors continue to be cautious on the matter. On the same vein, Gold has pulled back, following the stock market, and is still perceived as “good buy” in case of bad news from the WHO.

同时,随着对潜在的全球卫生紧急情况的情绪继续演化,美国政府债券的收益率下降。尽管股票市场已经从轻微的价格回调中恢复,但美国国债仍处于高价,这意味着主动投资者仍然保持谨慎。同样,黄金紧跟股市之后回落,但如果世卫组织发布不利消息,黄金仍被视为建议买入的资产。

Next week our macro spotlight will be on?

下周宏观焦点

Monday:

● Inflation Rate - China 通货膨胀率-中国

Tuesday:

● GDP Growth – UK GDP增长–英国

● Unemployment Rate - UK 失业率-英国

Wednesday:

● Industrial Production - Eurozone 工业产量-欧元区

Thursday:

● Inflation Rate – Ger 通货膨胀率–德国

● Inflation Rate - US 通货膨胀率-美国

Friday:

● GDP Growth – Ger GDP增长–德国

● GDP Growth – Eurozone GDP增长–欧元区

● Retail Sales – US 零售业销量–美国

● Industrial Production – US 工业产量–美国

● Manufacturing Production – US 制造业生产–美国

● Michigan Consumer Sentiment – US 密歇根州消费者信心指数–美国

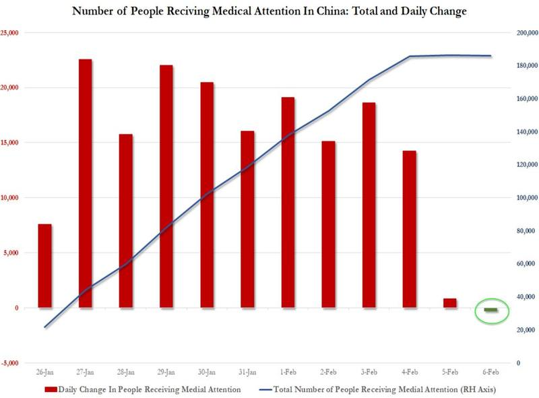

Chart of the week

Fact of the week 本周事件

The Fed is conducting research and experimentation related to distributed ledger technologies and their potential use case for digital currencies, including the potential for a CBDC.

美联储正在开展对分布式账本技术和该技术在电子货币上潜在用途方面的研究和试验,包括央行数字货币。

Quote of the week 本周语录

"Coronavirus will have a larger negative effect on the global economy than the SARS outbreak"——IHS Markit

“冠状病毒对全球经济的影响会超过SARS。”——IHS马基研究所